Novuna Personal Finance is part of Mitsubishi HC Capital Inc., led by Mr Robert Gordon, the Chief Executive Officer. Novuna Personal Finance was formerly known as Hitachi Finance when it was involved in mis-selling finance to timeshare owners.

Like their counterparts, Shawbrook Bank and Barclays Partner Finance, Novuna financed useless, aggressively sold timeshares while their personal lending arm returned millions of pounds in profit.

Novuna was named an ‘interested party’ in the Judicial Review proceedings that failed in May 2023. For eight-plus years, Novuna happily rejected timeshare consumers’ claims out of hand without any basis for doing so.

The Judicial Review vindicated the companies who have taken Novuna and the other banks involved to task for their decade or more of mis-selling of finance to facilitate the purchase of fractional timeshare products.

Novuna, like all other banks involved in this scandalous mis selling, allowed their loans to be sold by unregulated commission-based timeshare representatives. The fractional timeshare products were sold as ‘investments’, contrary to Directive 2008/122/EC of the European Parliament and of the Council. There is no defence as such; however, the banks have maintained an untenable stance and are now having to face up to their misdemeanours following a failed challenge at Judicial Review.

Unlike the other banks willing to engage in the settlement process, Novuna has chosen to ignore all communication with the representatives of the missold consumers.

We understand that the person responsible for dealing with these mis sold consumer claims is Mr Lee Cooper. (Below)

Complaints/Claims Relationship Manager at Novuna Consumer Finance

We understand from our contributors to this site that numerous emails have been sent to Mr Cooper on behalf of the affected consumers, but all emails to date have, to all intents and purposes, been ignored by Mr Cooper and his team. It would appear that by conduct, Novuna is refusing to abide by the findings of the judicial review.

This is not what one would expect from a responsible UK bank.

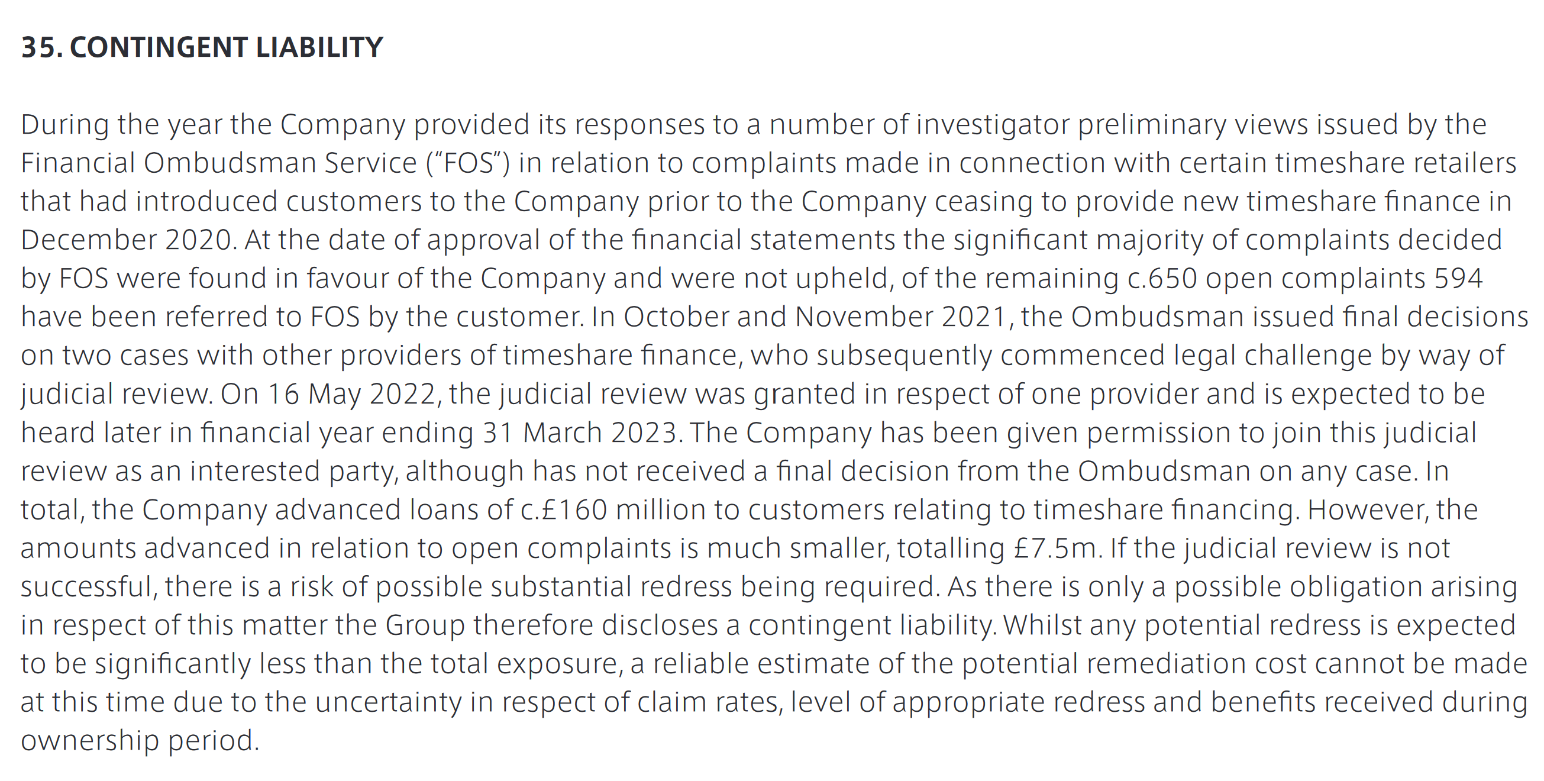

Here below is what appears in Novuna’s accounts for 2022/23. Novuna has made provisions for their mis-selling. However, the reality is that they continue to deny timeshare consumers a timely settlement of their claims. We are also advised that they continue to reject all new claims despite the findings of the judicial review, which is altogether disappointing as this exascerbates consumer detriment.

Entry from Novuna’s Accounts 2022/23

**UPDATE:

The Judicial Review case was NOT successful, and Novuna will have to pay back the monies loaned to all those who make a complaint, which falls within the findings of the Judicial Review.

There is a provision of £160 million mentioned within the ‘Contingent Liability’ statement, and we will be petitioning the FCA to impose a Remediation Order upon all of the banks involved in this mis-selling scandal.

If you or someone you know has been a victim of Novuna Personal Finance mis-selling financial products and have presented a mis-selling claim to them or the Financial Ombudsman Service and you think you have been mistreated, we want to hear from you.

Please email us with your story in strict confidence at npf@timeshare-banking-scandal.co.uk

If we can publicise your story, we will contact you.

If you currently work or have previously worked at Novuna Personal Finance and want to be a Whistleblower, you are entitled to anonymity under the Public Interest Disclosure Act 1998

CONTACT US IN THE STRICT CONFIDENCE AT whistleblowers.npf@timeshare-banking-scandal.co.uk

This website seeks to expose the injustices of a system of quasi-law that allows the UK’s largest regulator, the Financial Conduct Authority (FCA), and their arbiter, the Financial Ombudsman Service (FOS), that fails to deliver an effective, fair and accessible Alternative Dispute Resolution to UK consumers who it is intended to protect against the inequities and misdemeanours of the financial and insurance institutions. PPI, PENSIONS and NOW TIMESHARE.